Metaverse is a digital reality to shop, play, watch, buy, sell, and do pretty much whatever we do in this mortal physical world. Just that metaverse happens on computer servers, as the social media. But while social media is limited to sharing text, images, and video, the metaverse is complete virtual living. You live as an avatar within the metaverse, leading a virtual life, hanging out with other virtual people, enjoying live performances, doing business, and whatnot. Brands have started taking this seriously. Some like Samsung are opening metaverse exhibition centers, while others like Mcdonald’s are filing trademarks for virtual restaurants that will deliver food to this real world. And there is a lot on the plate with the top metaverse companies and metaverse crypto coins. But we will stay focussed on just one aspect:

Metaverse Investments

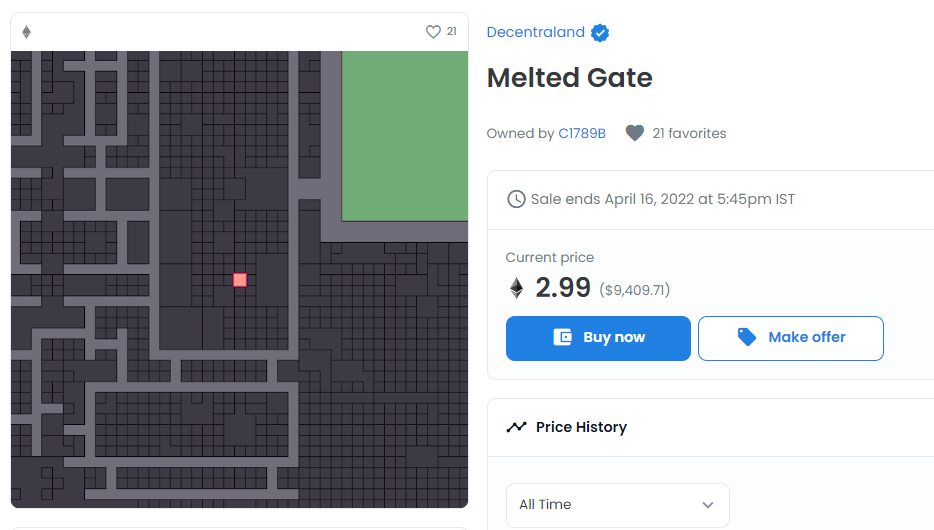

Let’s start with a formal warning: (Metaverse) Investments are Risky. But then, every investment is. It’s the same as it was with Bitcoin ten years ago. People were laughing at computer coins, ridiculing them as investment opportunities. Now with Bitcoin value soaring through the skies, it’s not wrong to say that jokes on them. Metaverse land parcels can be repeating that history. At least the past few years are a testament to that. Let’s take a look at one transaction history of a Decentraland land parcel listed at Opensea: As evident, the first transaction netted over 100% profit to the owner in less than a year. And the second one carved in over 16% returns in a matter of three days. But it can be an exception. So have a look at another: Don’t get me wrong. The purpose is not to push you into a frenzied buying spree of land parcels in the metaverse. Moreover, you can see the loss during the third sale and only marginal profit in the fourth. But again, the parcel also gave a monstrous 1600% return to the first owner over the course of three years. Similarly, many more transactions put their investors into lucrative gains, with an almost equal number of loss-making entries too. And it would help to know that metaverse investments work on the same supply and demand principles. For example, the metaverse project you buy land into can fail to attract visitors, leading to your investment biting the dust. Alternatively, it can also help you make good fortunes in short timeframes. But we are not financial advisors. Instead, this article is centered around how to invest (buy land) in the metaverse, only if you want to do that in the first place.

How Metaverse Investments Work

Technically, metaverse land parcels are non-fungible tokens. When you purchase an NFT signifying a specific plot in a particular metaverse, it remains on the respective blockchain. You can check out the history associated with each right from the start. So purchasing land in any metaverse basically has these five steps:

Selecting the Metaverse Choosing the Land-Plot Creating a Relevant Crypto Wallet Making the Purchase Verifying Transactions on Blockchain

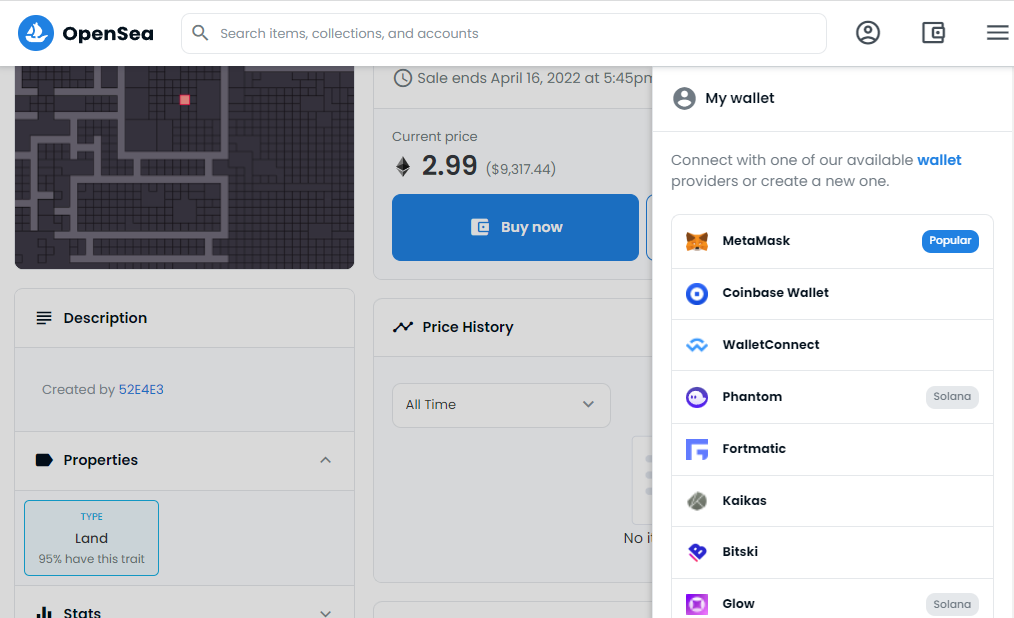

Let’s break down the mentioned process for a specific land plot on Decentraland: This is listed on a well-known NFT marketplace, Opensea. Since the price is in Ethereum (2.99 ETH), you’ll have to create a compatible wallet. One fine choice is Metamask if you’re okay with hot wallets. Afterward, you’ll have to load the wallet with the required transaction amount plus some extra to cover the transaction fees. Depending on the wallet, there can be an inbuilt exchange like it is with the Trust wallet or Coinbase Wallet. Or, you can purchase it at any exchange and transfer it to your wallet address afterward. Subsequently, you will click Buy now and will be prompted to connect your wallet to the marketplace: From here on onwards, the process depends on the wallet at hand. But you will be fine if you can follow the onscreen prompts. Based on the transaction fee and network conditions, the transaction will complete in due course of time. Finally, you can validate the transaction and the ownership on the respective blockchain. Now that you know the general process let’s move on to some platforms to purchase metaverse land.

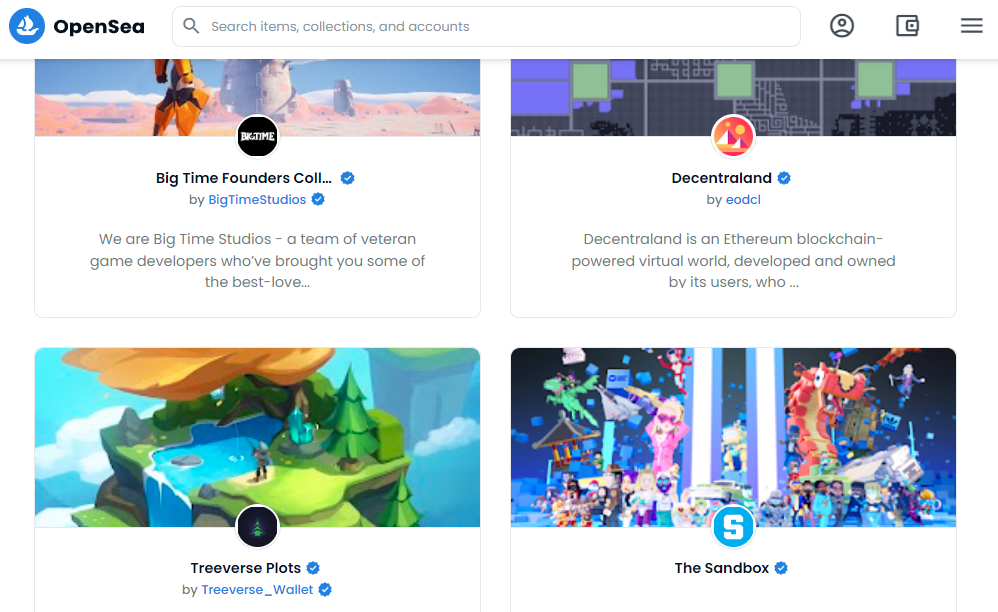

Opensea

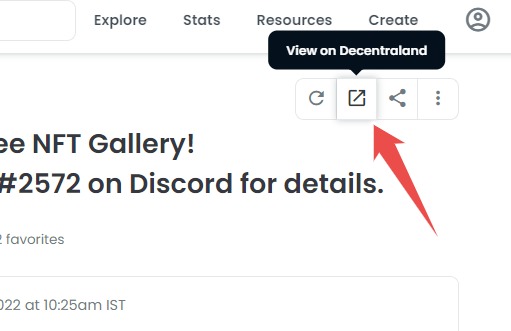

Opensea is a one-stop solution to trade assets in multiple metaverses. Just select the virtual world of your choice, select the parcel, and proceed with the purchase. You should also click over this redirect sign to verify the details on the actual metaverse marketplace before buying: Conclusively, Opensea makes it easy by putting everything on a single website. In addition, you can directly purchase for specific cryptocurrency in Opensea with your credit card without needing to buy it at any exchange and then transfer.

Decentraland

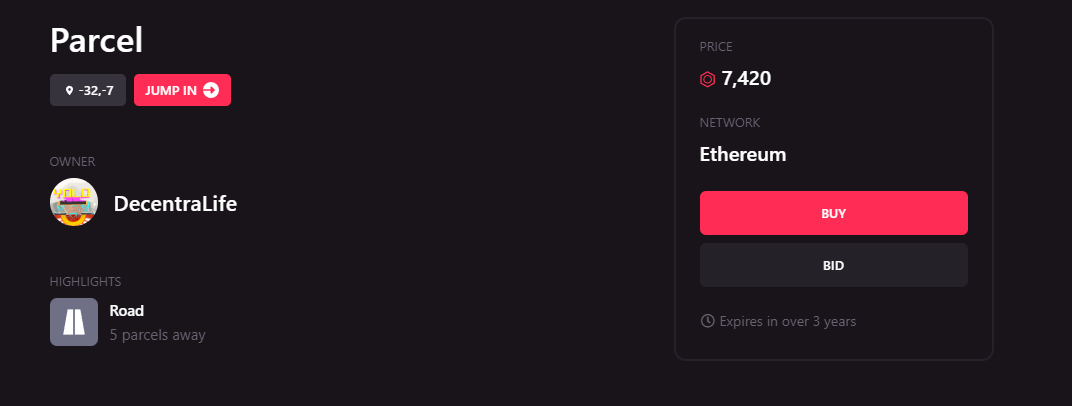

Decentraland is a top-rated metaverse project. Its native cryptocurrency MANA consistently tops the list of metaverse coins. Decentraland supports signup via Metamask wallet and purchases with MANA. MANA is available at major crypto exchange platforms, including Coinbase, Binance, Huobi, etc. So you have to purchase MANA at any of these available platforms and send it to Metamask. In addition, you’ll need some ETH to pay for transaction fees. Finally, you can select the parcel and click buy or place a bid. Bidding allows you to offer any price you see fit with an expiration date, leaving it to the owner to accept it or let it pass.

The Sandbox

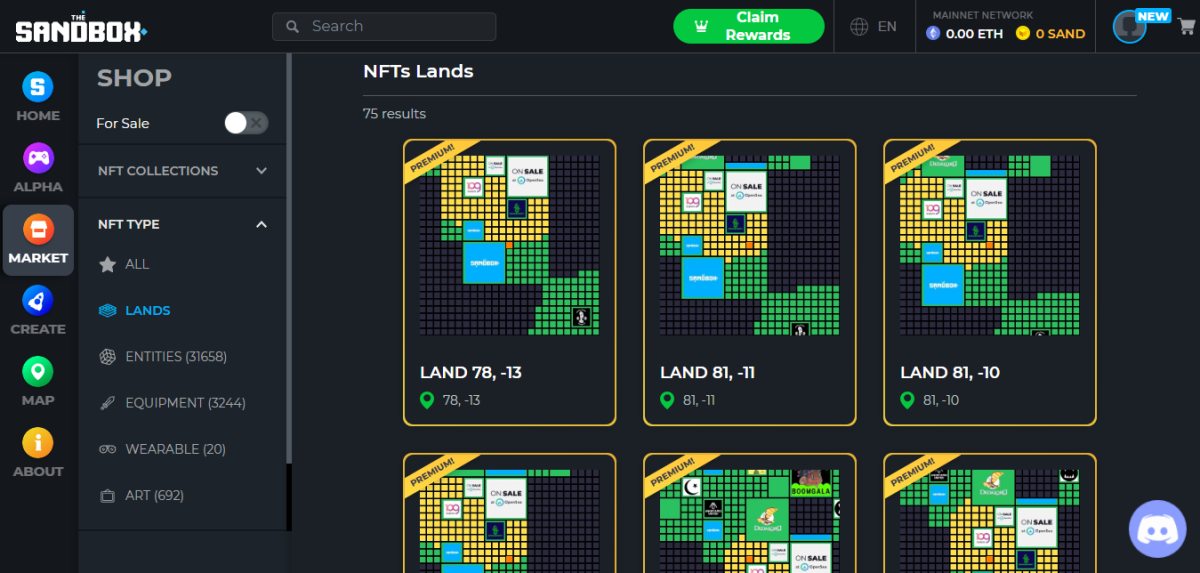

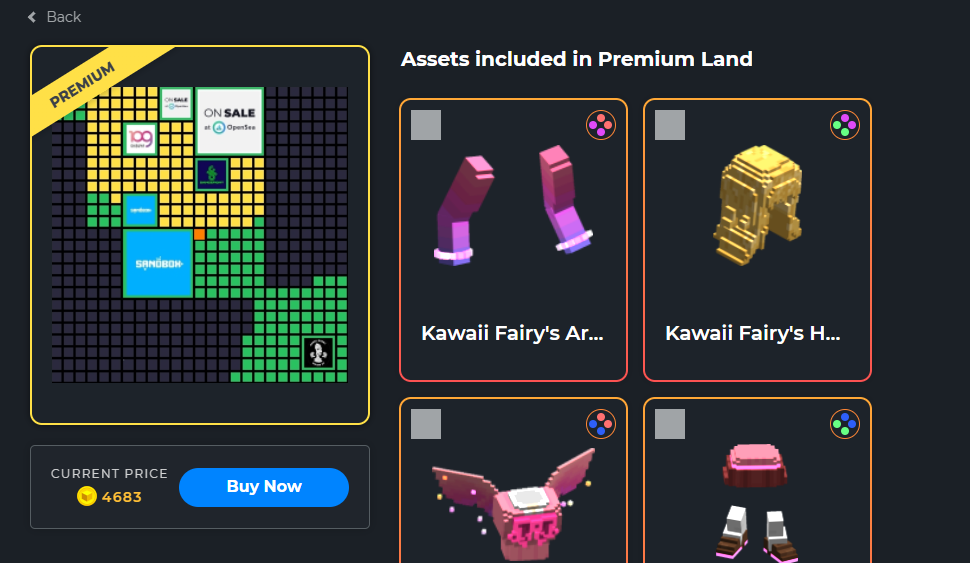

The Sandbox stands second in line after Decentraland for the best metaverse projects to buy land into. Sandbox permits signing up with a variety of options like Metamask, Coinbase, and Bitski. In addition, you can log in via Facebook, Google, and Twitter to use the Vinyl wallet for the signup. The method to buy real estate in The Sandbox is similar to Decentraland. And likewise, you need to have its native crypto, SAND, and some ETH, to make the purchase. After loading your crypto wallet with SAND, you can browse through the LANDS sections under the MARKET tab to select your pick. Afterward, it’s a few clicks, including tapping the Buy Now and signing the transaction in your wallet.

Somnium Space

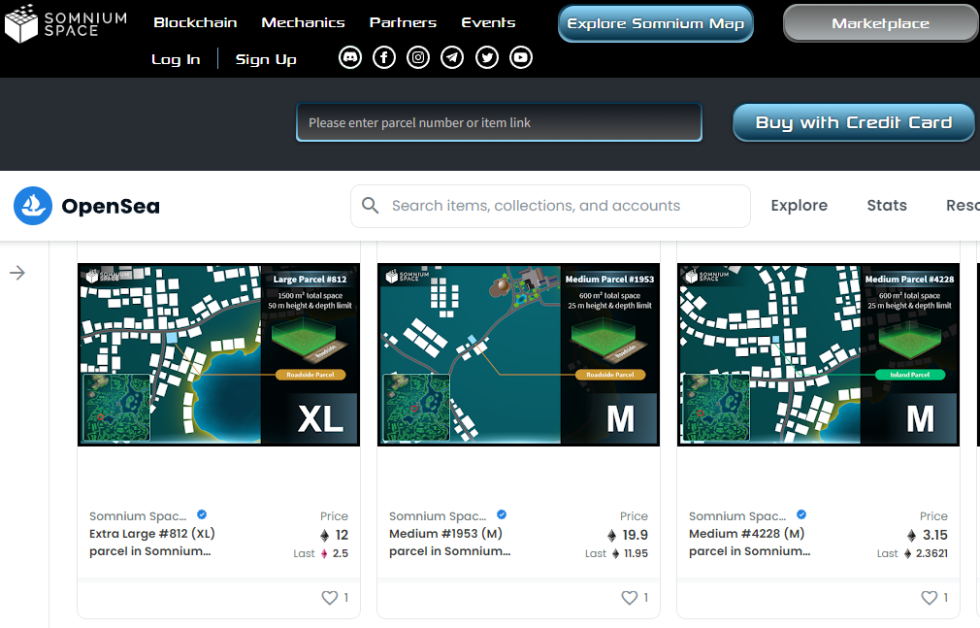

Somnium Space is a comparatively new metaverse that handles its marketplace via Opensea. What makes it different is that it is virtual reality compatible while most of its established rivals aren’t. You need to connect it to Metamask and purchase the parcel of your choice with ETH.

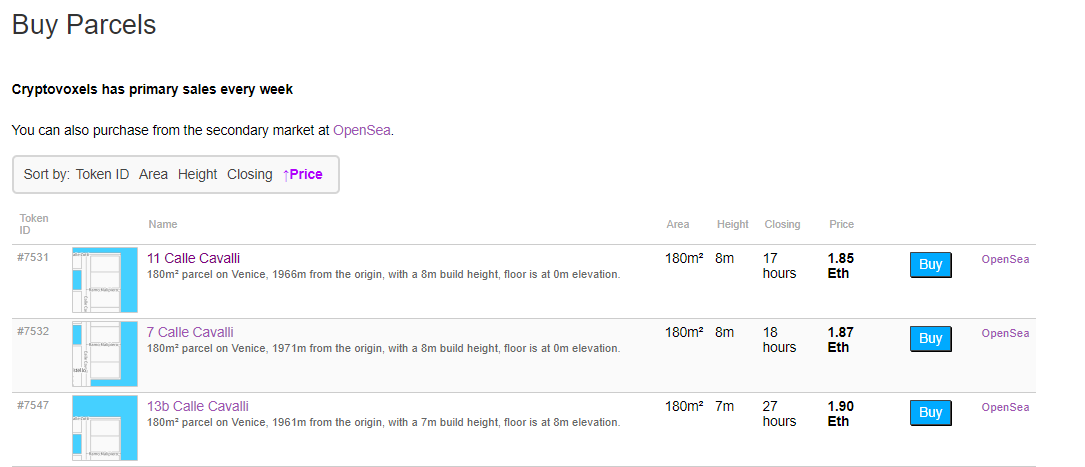

CryptoVoxels

CryptoVoxels is another Ethereum-based metaverse in the list of virtual worlds. It supports signup with Metamask, Coinbase, Torus Wallet, and Wallet Connect. One can either buy at the official website or check out the same at Opensea with the given links against each parcel.

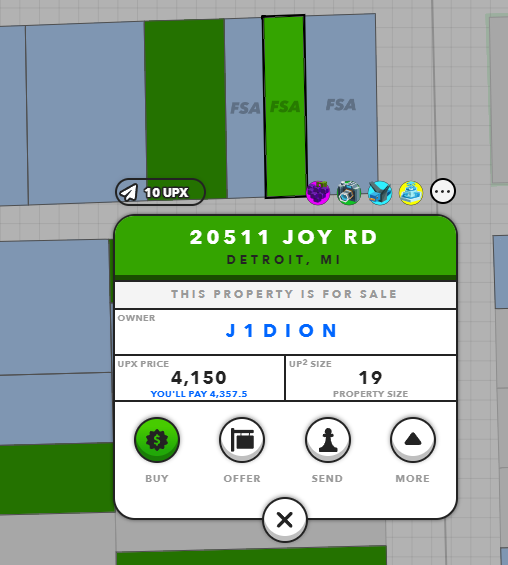

Upland

Upland is still a new metaverse with affordable land prices that won’t set you back thousands of dollars. This is different as each property is associated with a real-world address. Another difference is the signup process which doesn’t ask for any crypto wallet. Instead, you get in by creating an account with your email and password. The Upland registration gifts you 4,550 in UPX, their native currency. In addition, you get the tag of Visitor with a seven-day visa. You can renew the visa by just logging in when it expires with a grace period of one day. If you fail to do it, your UPX will be sent back, and you have to start afresh. For buying properties in Upland, you need a higher status of an Uplander. This means possession of 10,000 UPX, which can be purchased within the platform with Paypal or crypto. Once you hit that milestone, browse through the maps, select the property, and follow the onscreen instructions. Besides, all Uplanders have their assets on the blockchain, guaranteeing immutability.

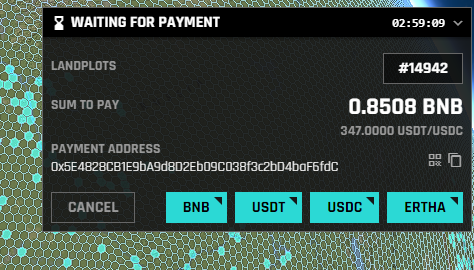

ERTHA

ERTHA is a life-simulation metaverse that has divided the planet into hexagons of land parcels available for purchase. Hosted on Binance Smart Chain, each ERTHA land parcel is unique with its resources and location. Purchasing land in this metaverse is a lot similar to what we have discussed so far. The first step is to select the specific hexagon and click ADD TO CART. Subsequently, select the available options (BNB, USDT, etc.) to open the Metamask to complete the transaction. Alternatively, you can copy the payment address, transfer the amount, and wait for confirmation.

Conclusion

This was a very concise list, and there are many more metaverse land projects to invest in. As already stated, metaverse investments are riskier owing to the crypto volatility and depend on the project success rate as well. On a side note, you can check out these platforms to sell your NFTs.

![]()